How often do you talk to your friends or co-workers about your salary or about money in general? For many years talking about one’s finances has been a taboo subject, but things are starting to shift, and it is a topic that is becoming more openly discussed—with more nonprofits, blogs, and celebs talking about equal pay. Income disparity won’t get any better if we never talk about it; the wage gap is real, and it won’t change if we ignore these conversations.

Even among our own Get Lit team, our experiences differ. My friends and I rarely talk about our finances, salary, 401(k), etc., but Shefali and her friends openly discuss these topics and offer each other advice.

Refinery29 Money Diaries began as a blog encouraging women to speak openly about their finances. The book, which is out now (I’ve already learned some new tips, so it’s definitely worth the $$$), shares realistic advice on how to save, ask for a raise, and more! We still have a long way to go to further open conversations about finances, but blogs like Money Diaries are definitely helping make it less taboo.

Last October, New York City made it illegal for public and private employers to ask about an applicant’s salary history during the hiring process. This new law was put in place to help ensure that everyone is paid based on their skills and qualifications, not their previous salary. If you check out the stats from the excerpt below, you’ll understand why this is especially important to women and people of color.

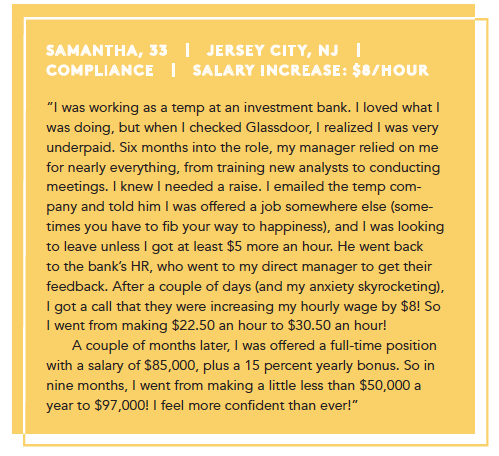

Read this excerpt from Money Diaries to find out how one woman succeeded in getting a huge salary increase to get paid what she deserved!

There are many reasons why women should want to take control of their finances, but I would argue the most compelling is the fact that we make less money than men. You probably know the stats by heart by now: On average, women who work full-time make 80 cents to every dollar their male counterpart makes. Black women make just 64 cents, and Hispanic women make a measly 54 cents. The data suggest we won’t reach pay parity in the United States until 2152. That’s 134 f*cking years.

Unequal pay is just one of many workplace problems we face. A 2017 Pew Research Center poll found that four in ten women have been discriminated against at work. A Wall Street Journal/NBC poll found that nearly half of women have faced some kind of sexual harassment in the workplace. Talk about an ambition killer.

Yes, there are a lot of systemic obstacles holding working women back—but lack of financial savvy should never be one of them…. We want to arm you with the tools you need to navigate the financial side of the workplace, from understanding your whole compensation package to negotiating a raise.

Like all personal finance advice, there’s no one-size-fits-all solution to work and money…. Because the only way we’re going to destroy the glass ceiling is if we help each other out along the way.

✨ BONUS! ✨Looking for some tips on how to save ? right now? Our friends at Tips on Life & Love offer some suggestions from the book you can start using this week!

✨ BONUS! ✨Looking for some tips on how to save ? right now? Our friends at Tips on Life & Love offer some suggestions from the book you can start using this week!

This post was originally published on GetLiterary.com.